Best Way To Invest Money In Stocks

Investing is a bit like going to the gym — it's something we know is likely to be good for us but we don't do it as often as we should.

One of the problems with overcoming this is that, from the outside, investing can seem confusing.

There are lots of numbers, acronyms and pieces of lingo that can make things overwhelming for anyone trying to figure out how to invest in stocks.

Mike knows

But investing in stocks — or any similar assets — doesn't need to be tricky.

If you read through this guide, you'll be able to learn the basics about why you should invest, how you do it and what you can buy. It's like the Freetrade version of stock investing for dummies (only for smart people).

So if you've been trying to figure out how to invest in stocks from the UK, read on and we'll reveal all.

The rise of the retail investor

Retail investors — that's regular people as opposed to companies or wealthy individuals — have always played a role in the stock market.

But in the past it was much harder for them to invest. High transaction costs and technology that made it hard to access the markets combined to make it difficult for the average person to invest in stocks.

That's changed over the past couple of decades as low-cost providers, benefitting from improvements in technology, have entered the market and made it simpler for retail investors to access the stock market.

Why should you invest?

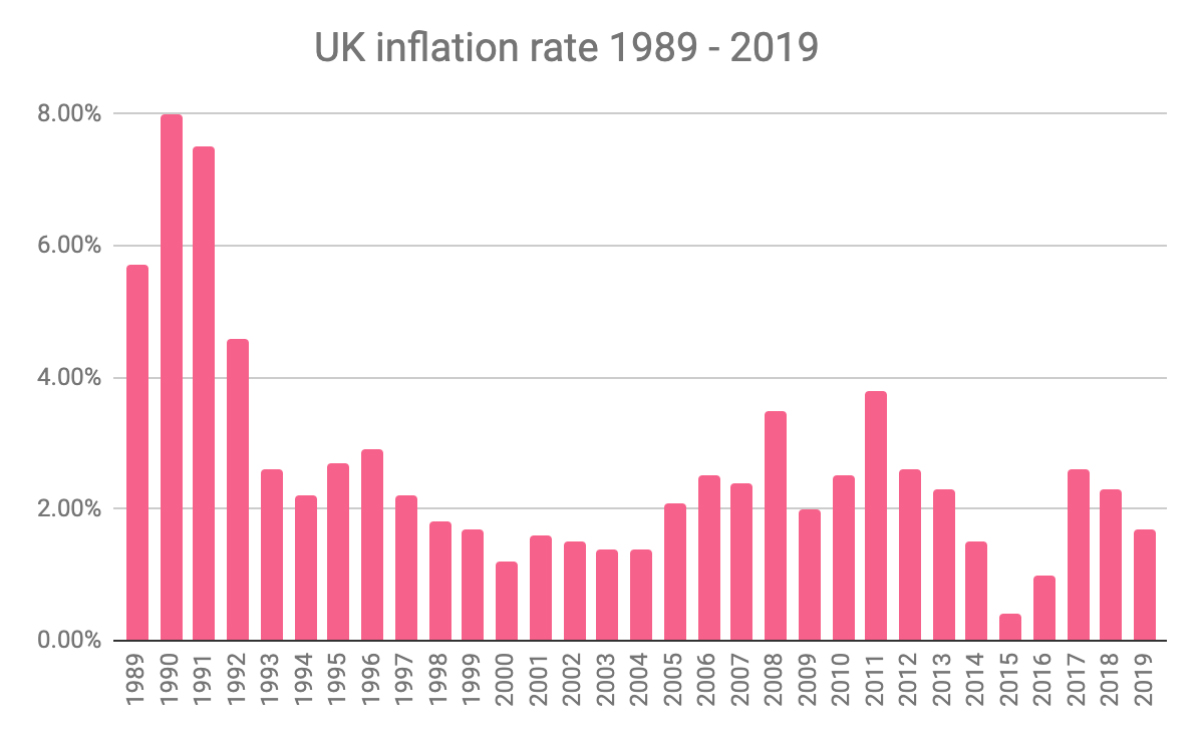

Looking back over the last few decades, investing in stocks has been one of the best ways to beat inflation.

Over time, the value of money changes and the cost of a good (milk, beer) or service (a haircut) that you can buy will increase or, in some cases, decrease.

Let's say you set aside £10,000 in a bank account in 1989, earning 0 percent interest.

The cash is safe and secure, but over time the amount that you can purchase with that money steadily decreases.

As of 2019, the value of that cash has decreased by over 50 per cent, meaning that you can only buy about half of the goods that you could have purchased back in 1989 with the same money.

Most savings accounts don't pay 0 per cent interest. But some UK savings accounts still pay interest that is lower than the rate of inflation.

For example, the average return on a fixed rate cash ISA in 2019 was 1.28 per cent but the inflation rate was 1.79 per cent, meaning account holders actually lost money in real terms.

Investing in a diversified portfolio of stocks has generally been a good way of countering this negative problem.

Check out this 'why invest' piece we've written, if you want to dig deeper into some of the reasons to invest.

What are stocks?

Stocks represent ownership in a company. So when you invest in stocks, you are buying a small stake in a business.

This is why you'll usually see the value of stocks fall or rise according to how well a business is doing.

If a company is making much bigger profits than expected then its share price will likely rise.

The reverse is also true. A company doing worse than expected is likely to see its share price fall.

You'll often hear the phrases 'stocks' and 'shares' used interchangeably, something that can be confusing for investing newbies.

The only difference between the two is that 'shares' is generally used to refer to stocks in a single company. 'Stocks' is generally used to refer to stocks in more than one company.

How does the stock market work?

The stock market is where people go to buy and sell stocks. They generally do this on a stock exchange.

A stock exchange is an institution that connects buyers and sellers of stocks.

In the past, people would have to physically go to an exchange in order to buy and sell stocks.

Technology has changed this entirely.

More and more of the mechanisms that let people find buyers or sellers and exchange their cash for stocks have been automated and digitised.

This means that a huge volume of trading now takes place electronically. A stock exchange will operate online systems that match buyers and sellers of stocks.

As a result, investors can now access exchanges online and use them to buy and sell stocks. This is generally done through brokers, that provide those investors with access to an exchange.

These technological developments have made it faster, simpler and cheaper to invest in stocks in the UK.

How does a company get listed on a stock exchange?

There are a couple of common ways that companies can list their shares on a stock exchange.

The most talked about way is through an 'Initial Public Offering' or IPO for short.

As the name suggests, this is a process by which a company sells a block of shares to public investors for the first time. That could include both companies and regular people.

An IPO is the most common way that a 'private' company 'goes public'. But it's not the only one.

A very popular way to go public at the moment involves something called a special acquisition corporations (SPACs). After a SPAC begins trading, its board will identify a private company with which to merge. As a result of the merger, investors can then buy and sell shares in the company on a stock exchange.

Learn more:

What is a SPAC?

SPACs vs IPOs

Why can't I buy IPO shares when the market opens?

If you're going to learn to invest, you're going to have to learn to deal with market volatility and the rising and falling of share prices.

There are a huge range of reasons why this happens. Some are hard to pinpoint and tricky to predict, like the ones that might cause the tech bubble to burst.

Still, there are some basic factors that you should be aware of before you invest.

Probably the most well understood ones are a company's current performance and how people think it will perform in the future.

For example, a firm that is making solid profits and looks likely to continue doing so, is more likely to have a strong share price than one which is bleeding money and looks like it's about to go bankrupt.

Having said this, a company could be losing loads of money but, if investors believe it will be extremely profitable in the future, then its share price may still rise.

Another important factor to consider is any external or internal force that could harm the company or make it more successful.

For example, if governments across the world decide to ban all flights, then shares in airline companies will be very likely to drop. Similarly, if a group of talented executives all leave a firm, that might spook investors and cause the company's share price to fall.

On the other hand, if the UK government decided to give huge subsidies to green energy companies, that could make shares in a solar panel producer rise.

So how do you get started investing? Let's take a look at some practicalities.

Open an investment account

If you're a first-time investor then you're going to have to open an investment account of some description.

An investment account will generally be with a stockbroker. A broker will connect you to the stock market, providing you with the means to invest in stocks and fractional shares.

Different brokers will provide different services and fees, so it's important to look at those things and decide what's right for you before you open an account. As a rule of thumb, the best investment app for you is likely to offer a balance between price and services. Also remember that some brokers have minimum deposits, meaning you can only use their services if you deposit a certain amount of cash with them.

Opening an investment account is simple but there are a few pieces of information that you'll need:

Your name

Your age

Your address

Your nationality

To help you get started we created a detailed, step-by-step guide on how to open a brokerage account .

Financial advice

It does take some time to figure out what the right way for you to invest is and getting advice isn't a bad idea if you feel a bit stuck.

Advisors do cost money but then it may be worth paying if it means feeling comfortable with what you're doing.

For most people, simply getting to grips with the basics of investing will be enough to set them on the right course. But if you're dealing with a complicated situation like inheritance planning it may be that a professional can add value.

There are lots of advisors out there and they charge a range of pricing. If you feel at a loss as to where to start looking for one then checking the UK government's Money Advice Service is a good place to start.

Should you use a traditional broker?

Anyone looking at how to get into stock trading will be bombarded with ads for companies providing investment services.

Some of these companies are older, traditional brokers. They may provide advisory services or let you open an account where you can choose your own investments.

These firms tend to charge higher fees for their services. Some people are happy to pay these fees because they feel more comfortable dealing with an established business.

In the past decade, however, several new firms have entered into the investment industry.

These tend to be tech-focused and operate online, whether via a browser or on a mobile app.

The main advantage of using these companies is that they tend to charge lower fees for their services. They also generally provide a more up-to-date set of technology, which tech-savvy investors may prefer.

Probably the biggest development with regard to pricing has been the removal of commissions. This is a flat fee that brokers charge you for executing trades.

Some brokers will fund these lower costs by selling customers high-risk investment products, such as CFDs or options. Others will cover their costs by providing a subscription service or charging fees for foreign exchange transactions.

Ultimately, deciding between a traditional broker and a newer business will come down to your own needs and preferences.

The best approach to take is to look at what services you need and how much you're willing to pay for them. Based on that information you can make a decision as to which broker to use.

Learn more:

Saving vs investing

Should you use a robo-adviser?

General Investment Account or Stocks and shares ISA

Investors in the UK have two main options when it comes to opening an investment account.

The first is a general investment account — or GIA. As its name implies, this is a simple share dealing account that lets you deposit cash and invest.

The other account on offer is a stocks and shares individual savings account (ISA).

A stocks and shares ISA is a tax-efficient investment account that is available to people in the UK.

The government allows people in the UK to deposit a certain amount of cash into a stocks and shares ISA each tax year. For the 2021/22 tax year, this amount is £20,000.

ISA account prices at different brokers, along with the different fees charged

The main benefit of an ISA is that it allows you, with some exceptions, to make investments that won't be subject to tax.

Because they have this benefit, a stocks and shares ISA will often cost more than a GIA.

But the tax benefits that you get from opening an ISA may not be necessary for you.

That's because the UK government also gives people tax allowances for investments held in GIAs. For 2021/22, this is £12,300 in capital gains — the profits you make from buying and selling assets — and £2,000 for dividends, payments that some companies will make to their shareholders.

So for anyone looking at how to invest in stocks in the UK, the choice between opening a GIA and stocks and shares ISA will come down to whether or not you think you'll exceed your tax allowances.

If you think you will eventually exceed it, it may be worth opening a stocks and shares ISA. If you won't, then it's probably better to open a GIA.

Having said this, you must remember that tax rules for ISAs can change and their benefits depend on your circumstances.

How do you make money from stocks?

Capital gains

The simplest way to make money from stocks is to buy a stock at one price and then sell it at a higher one.

This is known as a 'capital gain' and it can be subject to tax (more on this later on).

Dividend investing

The other way you're likely to make money from stocks is from dividends.

Dividends are payments that some companies make to shareholders, usually two or four times per year.

These payments generally take the form of cash and are expressed on a per share basis. So you'll receive a certain amount of money for every share you own in a company.

What are dividends?

Another possibility is you'll receive more stock in the company instead of a cash payment.

Looking specifically for dividend stocks to buy is one way to narrow down your investment options.

Just remember, the fact a company pays a dividend doesn't say much about how good it is as a business.

Lots of high performing companies don't pay dividends and plenty of businesses which are less promising still do. So don't think that a company is a must-buy just because it pays dividends.

Compounding

If you trace your family tree back one generation, you'll have two ancestors — your parents. Trace your family back 30 generations and you'll find 1.73 billion ancestors. This is an extreme example, and one that's very unlikely to happen if you invest, but it shows the power of compounding.

Compounding is one of the most powerful forces in investing.

Compounding is not a direct source of income in the way capital gains or dividends are.

Instead it's one of the benefits you can accrue as a long-term investor.

Compounding is the effect by which any growth you see is then built upon with further growth.

So even if the percentage at which your investments grow remains constant, the value by which they grow will increase over time.

We can see this in our family tree. Each generation we go back will double the number of ancestors you had in the prior generation. That means the rate at which your number of ancestors increases remains the same. But because of compounding, the actual number of ancestors that you have will grow more and more with each generation.

You can see this process in investing too.

For example, if you invested £10,000 and saw a 5% return for the following 10 years (reinvesting those gains back into your investments over the decade), the effect of compounding would be such that your investment would be worth £16,289 by the end of that period.

The power of compounding, playing out over a 40 year period

If you held the same investment but chose to take those income payments out instead of reinvesting them, you'd have made £15,000 — more than £1,000 less.

What returns to expect

People have a lot of stereotypes about the financial world and investing.

Films like the Wolf of Wall Street can make it seem like the stock market is one big cash grab and that the goal is to make huge sums of money in as short a period of time as possible.

The reality is different. Firstly, you can lose money by investing in stocks, even if there are ways of reducing the likelihood that this will happen.

Moreover, investors should try to take advantage of smaller, compounding gains over a long period of time and not massive short-term gains.

Famous investor Warren Buffet, for example, has said that a return of 6 or 7 per cent per year is a good goal for investors.

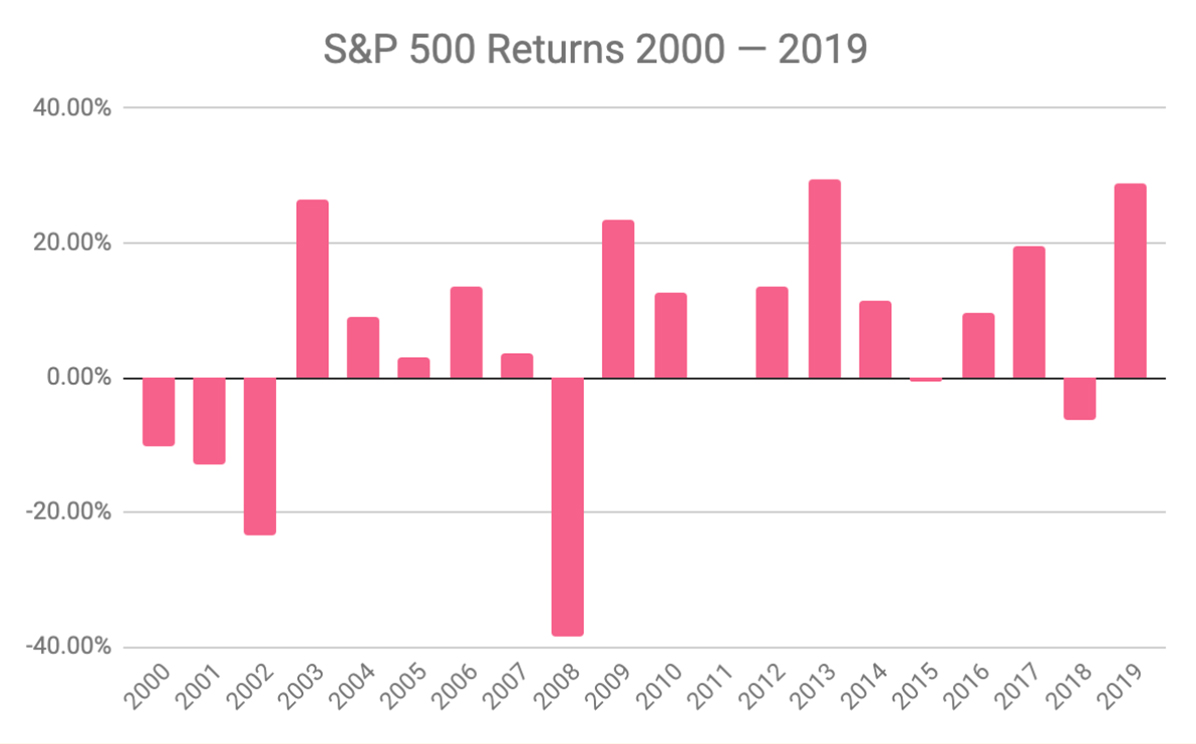

(Data source: Macrotrends)

We can see this by looking at the performance of an index, like the UK 100 or the S&P 500.

The UK 100 is a collection of 100 of the largest companies in the UK that have shares trading on the London Stock Exchange.

From 2000 to the end of 2019, the total return of the 100 largest UK companies was approximately 77 per cent or roughly 3 per cent a year.

Over the same period of time, the S&P 500 increased in value by 120 per cent or 6 per cent on a yearly basis.

Retirement planning

One of the main reasons people invest is to create a nest egg for their retirement. And in the UK a common way of doing that is to open a SIPP account.

SIPP is short for 'self-invested personal pension'. They're similar to ISAs in the sense they provide some tax efficiencies that make it an attractive option for retirement investing.

For example, your investments will be shielded from capital gains tax, as well as dividend tax on UK stocks. As with ISAs, you're still subject to stamp duty on UK stocks and may have to pay tax on any dividend income you receive from non-UK stocks.

But SIPPs are different from ISAs because they're designed specifically for retirement investing.

-

What is a SIPP?

-

How much do you need to retire?

-

Pension saving in your 20s and 30s

-

Pension saving in your 40s and 50s

The main consequence of this is you can't touch the money you invest in one until you're 55 and that's set to rise to 57 in 2028. Accessing your funds before then is likely to result in hefty taxes and fees that will substantially eat away at your holdings.

SIPPs don't have to be another pension account as you can transfer your pension to a SIPP.

When it comes to actually using the pot you've built up, you can take up to 25% of the value of your holdings without paying tax. The remainder will be subject to income tax.

This is not an exhaustive description of SIPP accounts, so if you want to learn more about them then read our guide on the subject. You should also consider speaking to a financial advisor if you are unsure about how to invest for your retirement.

SIPP vs ISA

Given there are some similarities between them, it's easy to slip into thinking you have a binary choice of SIPP vs ISA.

The reality is the two can quite easily complement each other. Both offer tax efficiency but the two accounts can be used for different purposes.

SIPPs are designed for pension investing and that's the main benefit you accrue by using them — you can prepare for your post-work life. Amalgamating any existing pension pots you have into one account, for example, is a handy thing to be able to do.

But because ISAs do not have the same curbs attached to them, in terms of age limits on withdrawals, they are easier to use for shorter term investment goals. That could be buying a house or helping pay for any of your children's pricier life expenses. There's also nothing stopping you from building up part of your pension in your ISA alongside a SIPP.

What to consider before you start investing

"How do I even begin to invest in the stock market?" is something that many first-time investors will often ask – usually with despair in their voice.

Thankfully, things don't have to be too complicated.

Asking yourself a series of simple questions involving your own financial circumstances and goals can help you figure out how to start investing in stocks.

Determine your goals

It may sound obvious but, before you start buying any stocks, you should figure out what you want to achieve by investing.

Some people invest to save for their retirement. Others may just want to beat inflation.

Understanding what your goals are is important because it can help you decide what the best stocks to buy are, taking into account your own circumstances.

If you don't figure out what your goals are, you may end up taking on too much risk and losing money that you can't afford to lose.

Learn more: How to choose the best investment app for you

How much money should you be investing?

Investing in stocks or any other assets doesn't require some preset amount of cash.

Unfortunately, lots of first-time investors don't know how much to invest and so they want a cut and dry percentage or amount of money that they should be investing each month.

Instead, investors should look at their own set of financial circumstances and see what they can afford to do.

If you have no debts and are able to save 20 percent of your salary each month, then you could probably afford to invest 10 percent of your income on a monthly basis.

Conversely, if you are struggling to pay off your mortgage and have lots of credit card, the chances are that you'd be better off focusing on paying your debts before putting money into the stock market.

It's also worth remembering that it's always a good idea to keep some of your money in cash.

Life is full of expensive surprises and, if all your money is in the stock market, you may end up having to sell off some of your investments at a loss in order to pay for emergency expenses.

Focus on the long term

Many people seem to view stock investment as a means of getting rich extremely quickly.

It would be nice if this were true but, in all likelihood, you are going to be better off investing for the long-run.

Over a prolonged period of time, diversified stock portfolios have historically risen in value and provided inflation-beating returns to investors.

Conversely, many investors that attempt to find the 'best' stocks to buy for short-term gains will end up losing money. This is true of experienced professionals, not just people learning to invest.

This isn't to say that there are never short-term opportunities in the stock market or that no one makes money from them.

But these come with risk and are hard to get right consistently, meaning you may well lose more than you gain if you invest all of your portfolio in this way.

What is your risk appetite?

Risk is arguably the most important concept to understand for anyone looking at how to start investing in stocks.

The easiest way to think about risk is that it's a way of quantifying how much money you are prepared to lose in order to see a gain. The more risk you take on, the more you stand to lose or gain.

Your risk appetite will be determined by your own set of circumstances.

Some simple things to take into consideration are time and money.

If you are investing over a long period of time, you can probably afford to take on more risk than someone that's going to need to sell off their investments in the near future.

Of course, money is also important here.

If you don't have a huge amount of cash, either to invest or in savings, then you'll probably want to take on less risk than someone with millions of pounds in the bank.

To help you understand this topic better, we've wrote a detailed guide to investment risk .

Commissions, fees and taxes

Personal allowance

The UK government gives people a personal allowance for their investments each year. There are separate allowances for capital gains and dividends.

The allowance is a set amount that you can earn without having to pay tax. For the 2021/22 tax year:

-

The capital gains allowance is £12,300.

-

The dividends allowance is £2,000.

That means you can earn up to £12,300 from capital gains or £2,000 from dividends and you won't have to pay tax.

Allowances do not carry over, so if you don't use your allowance one year, you can't double up your allowance the next year.

Capital gains tax

Capital gains tax is applicable to profitable gains you make on your investments over and above your personal allowance. It only applies to the gains you make, not the total amount.

So if you bought 100 shares for £10,000 and sold those shares for £20,000, the £10,000 profit you made would be the capital gain and would potentially be subject to capital gains tax.

As we've seen in the personal allowance section above, people in the UK can make a certain amount in capital gains in a given year and have it remain tax free.

For the 2021/22 tax year:

-

Basic rate taxpayers are subject to a 10% capital gains tax. This changes to 18% for any property that is not your home.

-

Higher and additional rate taxpayers are subject to a 20% capital gains tax. This changes to 28% for any property that is not your home.

Capital gains tax does not apply to investments in a stocks and shares ISA or a SIPP.

Dividend tax

Dividend tax is applicable to any dividend income you receive.

You have a dividend allowance that is £2,000 for the 2021/22 tax year, so any dividend payments you receive below that amount aren't subject to tax.

How much you pay if you make more than £2,000 depends on the tax band you fit into.

For the 2021/22 tax year, dividend tax applies as follows;

-

Basic rate taxpayers pay 7.5%

-

Higher rate taxpayers pay 32.5%

-

Additional rate taxpayers pay 38.1%

One thing you also need to be aware of with dividends is that you may still have to pay tax on them, even if the shares they're attached to are in an ISA or SIPP.

The reason for this is that many non-UK stocks will have their dividends taxed at source in the country they're traded in. This is usually the case with US stocks, for example.

Stamp duty on shares

Stamp duty is applied to share purchases in the UK. It is set at 0.5% of the purchase amount and is paid on all electronic share purchases.

You will pay stamp duty even if you're buying shares in an ISA or SIPP.

Stamp duty is only paid on purchases, not on sales.

Tax wrappers

You'll sometimes hear about 'tax wrappers' in reference to UK investments or investment products.

This is a way of describing SIPPs, ISAs and other tax efficient accounts. The 'wrapper' word is used simply because the account is akin to a casing, but the investor chooses what goes inside of it.

What to invest in?

Once you've figured out what account to open and understood what your investment goals are, you're going to have to actually put your money into something.

Doing this for the first time can make people a little nervous!

When you begin looking at how to start investing in stocks, there are so many choices out there that you can feel slightly overwhelmed.

With so many options available to you, it can be hard to know where to invest your money or what stocks to invest in.

Aside from your own investment goals, understanding what's actually on offer is a good way of taking the right steps towards making your first investment.

Company stocks

As we've already seen, stocks represent ownership in a company.

This means they offer the best opportunity for you to enjoy the current or future success of a business.

Many big name firms have stocks that you can buy. That includes a range of companies, including Nike, Apple, Amazon, McDonald's or — of course — Greggs.

Some company stocks can be pricey. In the past, this may have meant they were prohibitively expensive for investors.

But today many stockbrokers offer investors access to fractional shares. These are parts of a single share that you can buy. For example, if a share cost $1,000, you could buy half — or $500-worth — of that share.

Stocks are generally considered to be riskier than other investments. That's because they can be subject to hard to predict market forces that can lead to them declining in value.

Full list stocks and shares you can via the Freetrade investing app

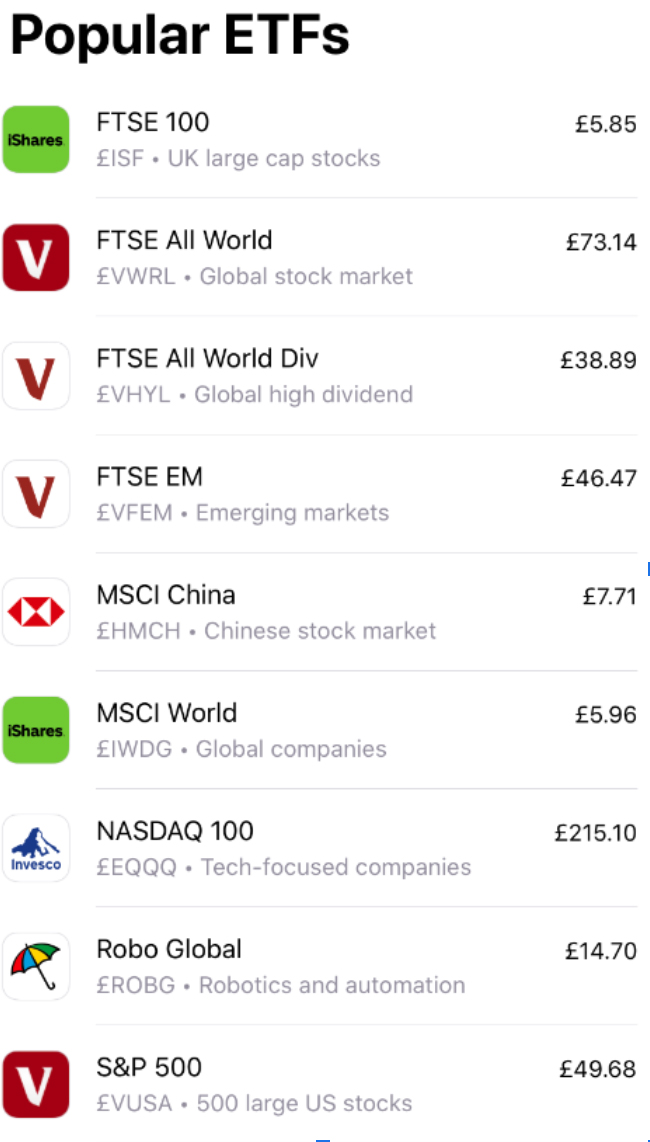

ETFs

An exchange-traded fund (ETF) gives you exposure to a collection of stocks or other assets.

For example, an ETF might hold stocks in 20 different technology companies. Investing in this ETF would give you exposure to each of those tech firms.

The most popular ETFs tend to track an index - like the S&P 500 or NASDAQ.

In the financial world, an index is a group of stocks or other assets that are put together and used for analysis or gauging how a market is performing.

For example, the S&P 500 is an index that comprises 500 of the largest companies trading on the US stock market. As such, it is often used by investors to see how the UK economy is performing.

An ETF that tracks the S&P 500 is a simple way of investing in the companies that make up the index.

From a practical point of view, this is much cheaper and faster than buying shares in each of those 100 companies. It also provides investors with a more diversified portfolio, reducing the risk that they may lose a large amount of money.

The downside to ETFs is that they mean you cannot capture the outsized returns that individual stocks can. You can also still be subject to market crashes, some of which may have a long-lasting impact on returns.

Full list of ETFs you can trade via the Freetrade investing app

Learn more:

What is an ETF - Guide

How to invest in ETFs

Five tips on how to use ETFs

Popular indexes for ETF trackers

-

UK 100 - This index is made up of the 100 largest companies on the London Stock Exchange by market capitalisation.

-

UK 250 - This index is made up of the 101st to 350th largest companies on the London Stock Exchange by market capitalisation.

-

UK All-Share - This index is made up of the 620 companies trading on the London Stock Exchange's Main Market.

-

S&P 500 - This index is made up of the 500 largest companies, by market capitalisation, trading on US stock exchanges.

-

The Nasdaq Composite Index - This index is made up of all the companies trading on the Nasdaq Stock Market.

-

The Dow Jones Industrial Average - This index tracks 30 companies in the US. The companies are chosen by editors of the Wall Street Journal newspaper and are supposed to reflect the US economy.

ETCs

Like an ETF, an exchange-traded commodity (ETC) tracks the price of an underlying asset.

The difference is that ETCs, as the name implies, track the price of commodities.

Commodities are raw materials, like gold and oil, or agricultural products, like oranges and wheat.

ETCs are useful because buying commodities directly can be expensive and extremely difficult logistically.

To understand this point, just imagine trying to buy a barrel of oil. How and where would you store it? How would you transport it? How would you sell it?

Now imagine just opening a brokerage account and clicking 'buy' on an oil ETC. It's much simpler than carrying around a barrel of oil.

The downside to ETCs is less to do with the products themselves and more to do with the assets they track. Commodities such as oil or oranges can be subject to wild swings in price and understanding the markets they trade in can require a lot of specialist knowledge.

Learn more:

Guide to investing in commodities

What is an inverse ETF?

Popular ETFs on the Freetrade app

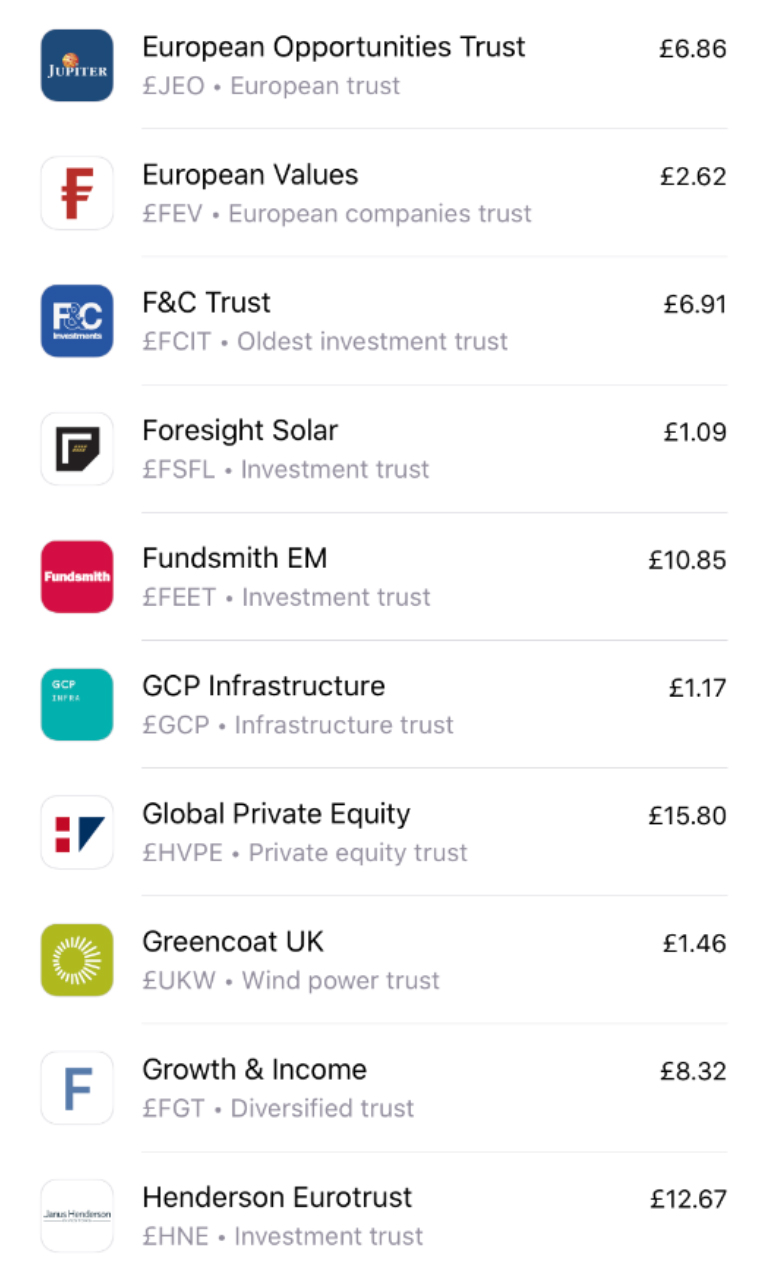

Investment trusts

Investment trusts are companies that are usually set up by asset management firms.

Once they've been established, they are listed on a stock exchange, giving investors the opportunity to buy shares in them.

The funds that are raised from this share sale are then used to invest in different assets.

For example, an investment trust might focus on buying stocks in the tech industry. Others hold a broader range of stocks and invest in industries as varied as telecoms, finance and energy.

Some investment trusts on Freetrade

One popular type of investment trust is known as a real estate investment trust — or REIT.

As the name implies, REITs invest in real estate. They're a good way for people to put money into the real estate market, without having to pay huge sums of cash for a home.

The obvious downside here is that many people want to buy a home as both an investment and a place to live. Investing in a REIT can help with the first of these goals but not the latter.

Like ETFs, investment trusts are a great way to get exposure to lots of different stocks or assets via one investment.

A key difference between the two is that investment trusts tend to have higher fees. This is because they are typically actively managed - meaning that they do not simply track an index, but a fund manager is required to make decisions on which stocks to buy and sell.

Full list of Investment Trusts you can trade via the Freetrade app

Learn more:

What is an investment trust and how does it work

What is a REIT?

How to build a diversified portfolio

Anyone investing in stocks should look to hold a diversified portfolio.

Your portfolio is made up of the stocks or other assets that you have invested in.

In simple terms, having a diversified portfolio means that you hold a range of assets. So if you're looking at how to diversify your portfolio, you need to consider how you spread out the money you're investing.

That might mean that you buy stocks in different industries. An investor with a diversified portfolio might hold stocks in tech, travel, energy, clothing and construction companies.

You don't have to limit yourself to stocks. For example, you could put a portion of your money into stocks but also invest in ETFs, REITs and ETCs.

It's also important to remember that cash can be an important part of your portfolio.

First-time investors will often look at how to invest in stocks and then start thinking that they have to put all their money into them. But holding cash is important.

You may need money to pay off emergency expenses. Alternatively, if there are new opportunities in the stock market, you will be better placed to take advantage of them if you have cash.

If you don't, you'll have to sell off assets — something that can stop you from making long-term gains or lead to you losing money.

Learn more:

2021 investment checklist - Resolutions to stick to

5 things you shouldn't do when you invest

5 things we can learn from investor Terry Smith

10 investment principles

Risk management

Diversifying your holdings is usually one part of what's known as 'risk management'.

It may not be the most exciting name but managing risk is arguably the most important part of investing.

Ultimately we invest to make money but that doesn't guarantee we will. The reverse can also happen, which is why we take steps to manage risk.

You can read more about investment risk in our guide on the topic.

Stock analysis basics

One of the most common problems people run up against when it comes to picking stocks is...well….what should you pick?

Starting out can feel daunting but it doesn't have to be. Probably the most important thing to realise is that there is no one 'right' answer here.

There is a reason different investors, professional and amateur, take a variety of approaches to their craft. It's because they've all got a set of criteria they use to determine what's a good investment and what's not. Only time will tell whether they're correct or not.

Some of the common methods people use to judge investments include:

-

Company fundamentals — This is a really broad term but it refers to anything tangible which is likely to impact a company. Looking at fundamentals means examining everything from a company's management, revenue and debt levels to its brand image, regulations that impact it and the effects of the wider economy on the business.

-

Revenue — This is how much money a company makes from selling its goods and services. Investors generally want to see that a company is making a stable or increasing amount of money. If not then there should be a good reason for it.

-

Net income — This is a fancy word for 'profit'. So once a company has paid all its debts, rent, employees, taxes and so on, how much does it have left? Investors generally look at net income relative to revenue. If you are keeping a good chunk of the money you earn in revenue as profit then that's often a sign of a healthy business.

-

Earnings per share (EPS) — This tells you how much a company makes in profit relative to how many shares it has. You calculate it by dividing a company's profit by its number of outstanding shares. The goal of EPS figures is to give you a better idea of how profitable a business is. Ultimately shares are a stake in a company, so a higher EPS means more profits are apportioned to you as a shareholder, even if those profits are not actually paid out to you in reality.

-

Price-to-earnings (P/E) ratio — A P/E ratio tells you how much a company's shares cost relative to its profit. It's calculated by taking a company's current share price and dividing it by its earnings per share. This means it gives you an idea of how expensive a company's shares are, at least in relation to how much money the company makes. As such it's probably the most common metric used to gauge how expensive a company's shares are.

When to sell your stocks

As with so many other things in the world of investing, deciding when to sell your stocks will largely be determined by your own goals and circumstances.

This means that you are going to have to do some thinking and self-examination — there is no 'golden bullet' that can tell you exactly when you should or shouldn't sell!

For example, if you are investing in stocks for your retirement, it may be best to simply leave them untouched until you retire. Making sure you have enough cash to pay for any expenses you have can help prevent you selling off stocks before this.

This is not to say that you should never sell stocks before you need cash. It's important to keep track of your stocks and shares to see how they're performing.

For example, if you have seen massive gains on one stock investment, you may want to sell off a part of those holdings or even all of them to realise that gain.

Similarly, you may have invested in stocks that have risen massively in value. If you believe those stocks are now overpriced and are likely to fall in value again, you may want to consider selling then.

To help you understand when is the right time to sell your shares, we wrote an entire guide to how to sell shares .

What are Freetrade investors buying?

If you're still not too sure how to invest your money, it might be worth looking at what others on Freetrade have bought.

It's important to remember that each Freetrade customer will have their own investment goals and risk appetite so you should adjust these insights according to your own position.

Always keep your own circumstances front-of-mind when making investment decisions.

Just remember that this should be the beginning of your investment journey. There are always things to learn, whether it's about risks or asset classes.

Top 10 stocks on Freetrade

We recently surveyed Freetrade users that have an ISA account with more than £10,000 invested to see what they're putting money into.

As you can see, Tesla is in the top spot. The electric carmaker has been very popular with lots of investors over the past couple of years and has seen its share price rise dramatically as a result. Things have slowed down a bit recently though, probably as people start to doubt whether the firm can grow enough to justify its high share price.

Further down the list we have some GameStop and Argo Blockchain. The former gained a lot of attention during the meme stock saga, something that's dipped in and out of the news since February 2021. Argo Blockchain wasn't quite the same but it also gained a lot of retail investor attention on the back of a surge in the price of Bitcoin.

Spread across the rest of the list are three ETFs. The iShares FTSE 100 and Vanguard S&P 500 are both index trackers, issued by iShares and Vanguard respectively. One thing here to be cautious of is the fact they both distribute dividends they receive, hence the '(dist.)' at the end of their names.

Top 10 assets for Freetrade users investing £10k in 2021

As we said in the compounding section of this guide, if you're taking these income payments out and not reinvesting them, you're reducing the ability of those returns to compound and generate returns of their own. So unless these investors are reinvesting their dividends very quickly, there's a chance they could be missing out on greater gains than they may otherwise receive.

Learn more: Last week's most popular shares on the Freetrade app

Top 5 sectors on Freetrade

Another interesting set of data from the Freetrade customers we sampled is the sectors that they invested in when buying stocks.

The financial services industry tops the list here, with 17 percent of all orders being in banks, insurers and credit card providers.

Top 5 sectors for Freetrade users investing £10k in 2021

Next on the list is tech, which includes big names like Apple, Amazon and Facebook. Just over 13 per cent of all the sampled orders were in tech firms.

A similar number of orders were made in the energy and food-and-drink industries, with approximately 16 percent of all stock investments made in each.

Last on the top 5 list is healthcare, which managed to attract close to 7 percent of our £10,000 investors' orders.

For more news and insights on stocks and shares, you can check our stock market analysis daily news.

Have a question or want to find out more?

The Freetrade community is a great place to ask questions if you're unsure about something.

You can also learn more about investment with our 'Building your portfolio' collection of learning material or by signing up to our daily stock market newsletter, Honey for a fresh dose of insights.

In the meantime, you can browse through the Freetrade app and see if there's anything that fits with what you're looking to achieve. Just don't go all-in on Tesla...

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.

When you invest, your capital is at risk. Tax rules for ISAs can change and their benefits depend on your circumstances. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

Best Way To Invest Money In Stocks

Source: https://freetrade.io/how-to-invest-in-stocks

Posted by: patersonfrok1965.blogspot.com

0 Response to "Best Way To Invest Money In Stocks"

Post a Comment